How I Optimized My Returns While Preparing to Move Abroad

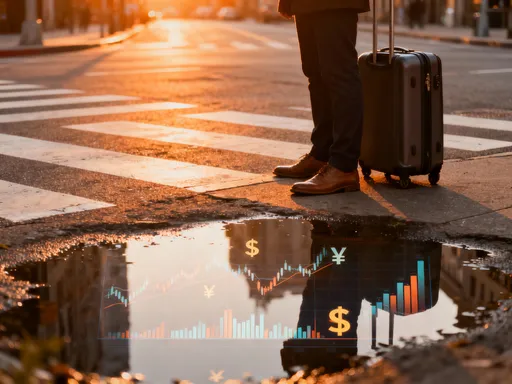

Thinking about moving to a new country? So was I—and I quickly realized that immigration isn’t just a lifestyle change, it’s a financial game-changer. From currency shifts to tax surprises, every decision impacts your wealth. I learned this the hard way. But over time, I built a system to protect and grow my money while preparing to leave. Here’s what actually works—no hype, just real strategies that helped me gain more from my assets while staying safe. It’s not about getting rich overnight. It’s about making thoughtful, coordinated choices that preserve value, reduce risk, and create long-term advantages. This is the financial side of moving abroad that few talk about—but everyone should know.

The Hidden Financial Side of Immigration

When most people plan an international move, they focus on visas, housing, schools, and jobs. These are essential, of course, but they often overshadow a deeper reality: immigration is one of the most significant financial transitions a person can make. It’s not just a change of address—it’s a full financial reset. The way you handle your money during this period can determine whether you arrive with strength or start from a position of loss. This is not an exaggeration. Every asset, every bank account, every investment must be reevaluated in the context of a new country, new currency, and new tax system.

One of the first things I discovered was that residency status affects taxation. In many countries, tax obligations are based on where you live, not where your money comes from. That means income from investments, rental properties, or even pensions could be taxed differently—or not at all—once you establish residency abroad. Some nations offer favorable tax treatment for new residents, such as temporary exemptions on foreign income. Others impose immediate liability. Understanding these rules early allows you to time your move strategically, potentially deferring or minimizing tax burdens. For example, realizing capital gains before or after a move can lead to vastly different tax outcomes, depending on the jurisdiction.

Another overlooked factor is currency conversion. When you sell assets in your home country, you typically receive funds in local currency. If you wait until you’ve relocated to convert that money, you’re exposed to exchange rate fluctuations. A weak home currency at the time of transfer means less purchasing power abroad. Conversely, converting too early can lock in unfavorable rates. The key is not to avoid currency risk altogether—that’s impossible—but to manage it intentionally. This requires monitoring exchange trends, understanding economic indicators, and knowing when to act.

Banking transitions also pose hidden challenges. Closing accounts, opening new ones, and transferring funds across borders involve fees, delays, and compliance checks. Some banks impose limits on international transfers or require extensive documentation. Others may freeze accounts temporarily due to unusual activity. These disruptions can affect cash flow at a critical time. Establishing relationships with financial institutions in your destination country before departure can ease this transition. It also allows you to set up accounts in advance, ensuring access to funds when you arrive.

Finally, asset liquidation timing matters. Selling property, stocks, or businesses too early means losing potential appreciation. Selling too late can create pressure during an already busy period. The goal is to align the timing of these actions with your departure date, tax strategy, and investment plans in the new country. This coordination turns what could be a series of reactive decisions into a proactive financial strategy. Immigration, when approached this way, becomes not just a relocation but a structured opportunity to reposition your wealth for greater efficiency and growth.

Why a System Beats Random Moves

Before I created a system, I made every mistake possible. I sold investments without checking tax implications. I transferred money through my regular bank and paid high fees. I assumed my home country’s financial rules would apply temporarily abroad—and was surprised by unexpected tax bills. These were not isolated incidents. They were symptoms of a larger problem: reacting instead of planning. Each decision was made in isolation, without considering how it connected to the next. The result? Lost money, stress, and missed opportunities.

What changed was adopting a structured approach. Instead of waiting for problems to arise, I began mapping out the entire financial journey—from 12 months before departure to six months after arrival. This timeline became the backbone of my system. It allowed me to identify key milestones: when to review investments, when to initiate transfers, when to close accounts, and when to open new ones. Each step had a purpose and a deadline. More importantly, each decision was made in the context of the whole plan, not in isolation.

The core of this system rests on four pillars: timeline mapping, jurisdiction analysis, liquidity planning, and goal alignment. Timeline mapping ensures that nothing is left to the last minute. For example, I scheduled property valuations six months before my move, giving me time to explore selling options. I set a three-month window for finalizing investment sales, allowing room for market shifts. Jurisdiction analysis helped me understand the tax and regulatory environment of my destination country. I researched whether it had tax treaties with my home country, how it treated foreign-sourced income, and what reporting requirements existed for new residents.

Liquidity planning ensured I had access to cash when I needed it. Moving involves expenses—shipping, deposits, temporary housing, legal fees—that require immediate payment. I calculated these costs in advance and set aside funds in a liquid, easily accessible account. At the same time, I avoided keeping too much in cash, knowing that inflation and currency risk could erode its value. Goal alignment tied everything back to my long-term financial objectives. Was I moving for a job, retirement, or family reasons? Each goal influenced how I structured my finances. A job-driven move might prioritize short-term stability, while a retirement relocation could focus on long-term income generation.

This system didn’t eliminate uncertainty—but it reduced chaos. It turned a complex, emotional process into a series of manageable steps. Most importantly, it allowed me to act with confidence, knowing that each decision supported the next. When you treat financial migration as a coordinated process, you stop losing money to poor timing, hidden fees, and avoidable mistakes. You start gaining from strategic positioning, tax efficiency, and disciplined execution. That’s the power of a system.

Maximizing Returns Before You Leave

Your home country may still hold untapped financial value—and the period before your departure is the best time to unlock it. This is not about rushing to sell everything. It’s about optimizing what you own to generate the highest possible net return before you go. The goal is to extract maximum value while minimizing tax and transaction costs. This requires careful timing, smart decision-making, and a clear understanding of how your assets behave in the final months before relocation.

One of the most impactful strategies is timing the sale of real estate. If you own property, its value may fluctuate based on local market conditions. Selling at the right moment can mean the difference between breaking even and gaining a significant profit. I monitored housing trends in my city for over a year before deciding to list. I noticed that prices peaked in the spring, driven by high demand from families relocating for school changes. By listing in early April, I sold above asking price and avoided the summer slowdown. That extra 7% in proceeds made a real difference when converted to my new currency.

Investment accounts also offer optimization opportunities. If you hold stocks, mutual funds, or retirement accounts, consider harvesting gains strategically. Realizing capital gains before you move can allow you to take advantage of lower tax rates in your home country. In some cases, long-term capital gains are taxed at a favorable rate, especially if you’re in a lower income bracket during your final year of residency. Conversely, if you wait until you’re a tax resident abroad, those gains might be taxed at a higher rate—or not qualify for exemptions. I reviewed my portfolio with a tax advisor and decided to sell certain appreciated assets before the end of the year, locking in gains at a 15% rate instead of risking a higher rate later.

Tax-efficient accounts, such as retirement savings plans, require special attention. Withdrawing funds early can trigger penalties and taxes. But leaving them behind may limit access or create reporting complications. One option is to roll over eligible accounts into international-friendly structures, if permitted. Another is to delay withdrawals until you understand the tax implications in your new country. I chose to maintain my retirement account but paused contributions in my final year, using the freed-up cash for relocation expenses instead.

Another consideration is whether to reinvest locally before leaving or move funds early. Reinvesting in short-term, low-risk instruments—like certificates of deposit or government bonds—can generate modest returns while preserving capital. Moving money early, on the other hand, allows you to begin earning interest in the new currency and avoid last-minute exchange pressure. However, it also exposes you to exchange rate risk if the home currency strengthens later. I opted for a partial transfer: moving 40% of my savings six months before departure, then reassessing based on exchange trends. This balanced approach gave me flexibility without overcommitting.

These decisions are not one-size-fits-all. They depend on your personal financial situation, the countries involved, and your timeline. But the principle remains the same: the months before departure are not just for packing. They are a critical window for financial optimization. By acting with intention, you can turn your final days in your home country into a period of strategic gain.

Protecting Your Purchasing Power in Transition

One of the biggest threats to financial stability during an international move is the loss of purchasing power during money transfers. It’s not uncommon for people to lose thousands of dollars—not to fraud or theft, but to poor exchange rates, high fees, and bad timing. These losses often go unnoticed because they happen gradually, embedded in transaction costs. But their impact is real: less money available for housing, healthcare, education, or investment in the new country.

The first step in protecting your money is choosing the right transfer method. Traditional banks often charge high fees and offer poor exchange rates, sometimes adding a 3–5% markup. I learned this the hard way when my first transfer cost $420 in fees and unfavorable conversion. After that, I switched to specialized international transfer services that offer competitive rates and lower fees. These platforms allow you to lock in exchange rates, set up recurring transfers, and track transactions in real time. While not risk-free, they provide more transparency and control.

Timing the exchange is equally important. Currency markets fluctuate daily based on economic data, interest rate decisions, and geopolitical events. Trying to predict the perfect moment is impossible—but waiting too long can be costly. A better approach is to monitor trends and act when rates are favorable. I used a simple rule: if the exchange rate improved by 2% compared to the six-month average, I transferred a portion of my funds. This dollar-cost averaging approach reduced the risk of moving all my money at a low point.

Another strategy is financial bridging—using short-term, liquid instruments to preserve value during the transition. Instead of keeping large sums in checking accounts, which earn little to no interest, I placed part of my savings in short-term money market funds. These offered modest returns with low risk and easy access. Once I established residency, I gradually moved these funds into local investment accounts. This bridging strategy ensured my money was working for me, even during the uncertain first months.

It’s also important to avoid common pitfalls, such as using credit cards for large transfers or relying on informal networks like friends or family to move cash. These methods can lead to high interest charges, compliance issues, or even legal problems. Staying within regulated financial channels may seem slower, but it protects your assets and ensures traceability. I made sure every transfer was documented and reported, reducing the risk of scrutiny from tax authorities in either country.

Protecting purchasing power isn’t about chasing high returns during transition. That would be risky and counterproductive. It’s about minimizing loss, maintaining liquidity, and preserving the value you’ve worked hard to build. When you arrive in your new home, you want to focus on settling in—not recovering from avoidable financial setbacks.

Building a New Financial Base with Confidence

Arriving in a new country doesn’t mean starting from zero. You bring skills, experience, and—most importantly—financial resources. The challenge is converting those resources into a stable, functional financial life in a new system. This involves opening local bank accounts, understanding tax residency rules, setting up payment methods, and beginning to invest. The decisions you make in the first few months can shape your financial trajectory for years.

Opening a local bank account is often the first step. But it’s not always straightforward. Some countries require proof of address, employment, or residency before allowing account access. I secured a temporary address through a short-term rental and used my visa and employment contract to meet requirements. I chose a bank with online services, international transfer capabilities, and English-language support, which made management easier during the adjustment period. Having a local account allowed me to pay bills, receive salary, and begin building credit history.

Understanding tax residency is crucial. In most countries, you become a tax resident after living there for 183 days or more in a year. Once that happens, you’re typically required to report worldwide income. This means your investments, rental income, or pensions from your home country may now be subject to local tax laws. I consulted a local tax advisor to understand reporting obligations and available deductions. This helped me avoid underpayment penalties and take advantage of any relief provisions.

Beginning to invest locally is another key step. I started with low-risk options: high-yield savings accounts and government-backed bonds. These provided stability while I learned about the financial market. Over time, I explored diversified index funds and retirement accounts available to residents. I paid close attention to contribution limits, tax treatment, and withdrawal rules. Aligning these investments with my long-term goals—such as retirement or education funding—ensured that my money was working toward meaningful objectives.

Practical tips helped me avoid delays. I organized all financial documents in advance: bank statements, tax returns, investment records. I kept digital and physical copies. I informed my home country institutions of my new address and updated beneficiaries. These small actions prevented compliance issues and ensured continuity. Building a new financial base isn’t about speed—it’s about accuracy, compliance, and long-term security.

Balancing Risk Without Sacrificing Growth

Moving to a new country introduces uncertainty—and uncertainty demands careful risk management. At the same time, being overly cautious can be just as harmful. Keeping all your money in cash may feel safe, but inflation and currency depreciation can quietly erode its value. Avoiding investment altogether means missing opportunities for growth. The goal is not to eliminate risk, but to manage it wisely—protecting your assets while positioning for future gains.

One effective strategy is diversifying across currencies. Holding some assets in your home currency, some in the new currency, and some in stable international currencies like the US dollar or euro can reduce exposure to any single economy. I allocated 60% of my liquid assets to the new currency, 20% to USD, and 20% to EUR. This mix provided stability during periods of local currency volatility. As I gained confidence in the new economy, I gradually increased my local exposure.

Reducing exposure to volatile assets during transition is also wise. I temporarily shifted a portion of my portfolio from high-growth stocks to bonds and dividend-paying funds. These offered lower returns but greater stability. Once I was settled, I began reinvesting in growth-oriented assets. This phased approach balanced safety with long-term objectives.

Maintaining emergency liquidity is essential. I kept six months of living expenses in a local high-yield savings account, easily accessible but separate from daily spending. This fund acted as a buffer against unexpected costs, job changes, or medical needs. Knowing it was there reduced stress and allowed me to make long-term decisions without panic.

The key is balance. Overprotecting your wealth can lead to stagnation. Overexposing it can lead to loss. By adjusting your portfolio thoughtfully during transition, you protect what you’ve built while staying open to future opportunities. Risk management isn’t about fear—it’s about preparation.

Putting It All Together: A Financial Blueprint for Moving Abroad

Immigration is a major life event, but it doesn’t have to be a financial setback. When approached with a clear, structured plan, it can become a powerful catalyst for long-term financial improvement. The strategies outlined here—understanding the financial dimensions of relocation, building a system, optimizing returns, protecting purchasing power, establishing a new base, and managing risk—are not isolated tactics. They are parts of a coherent framework that turns a complex transition into a strategic advantage.

Imagine a timeline: 12 months before departure, you begin analyzing tax implications and monitoring currency trends. Nine months out, you review and optimize investments. Six months before, you start partial transfers and open preliminary accounts abroad. Three months before, you finalize asset sales and lock in favorable exchange rates. At departure, you have liquidity, clarity, and control. In the first six months abroad, you establish residency, comply with tax rules, and begin investing locally. Each step builds on the last, creating momentum and confidence.

This blueprint isn’t about getting rich quickly. It’s about making smart, coordinated decisions that preserve value, reduce stress, and position you for growth. It’s about turning a daunting process into a structured opportunity. With the right system, moving abroad can be not just manageable—but financially transformative.